All Categories

Featured

Table of Contents

If you're a person with a low resistance for market variations, this insight might be indispensable - Indexed Universal Life premium options. Among the essential facets of any type of insurance coverage is its cost. IUL policies typically include numerous costs and fees that can influence their total value. An economic advisor can break down these prices and help you weigh them against other low-priced financial investment choices.

Pay specific focus to the policy's attributes which will be vital depending upon just how you desire to utilize the plan. Talk to an independent life insurance representative who can aid you choose the ideal indexed universal life policy for your demands.

Testimonial the policy meticulously. Currently that we've covered the benefits of IUL, it's crucial to understand how it compares to various other life insurance coverage plans offered in the market.

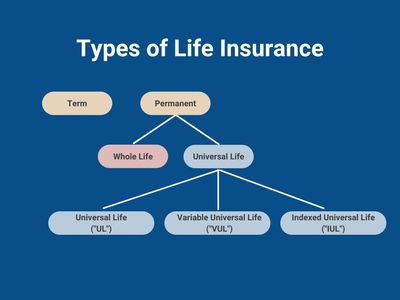

By understanding the similarities and differences between these plans, you can make a more educated decision about which kind of life insurance policy is finest fit for your needs and financial objectives. We'll begin by comparing index universal life with term life insurance coverage, which is commonly thought about one of the most uncomplicated and budget friendly sort of life insurance policy.

What is a simple explanation of High Cash Value Indexed Universal Life?

While IUL might supply higher possible returns because of its indexed cash value growth system, it likewise includes greater costs contrasted to label life insurance policy. Both IUL and whole life insurance coverage are kinds of long-term life insurance policy plans that offer survivor benefit defense and money worth development chances (Indexed Universal Life tax benefits). There are some crucial distinctions between these two kinds of plans that are vital to think about when determining which one is best for you.

When taking into consideration IUL vs. all other kinds of life insurance policy, it's vital to consider the benefits and drawbacks of each plan kind and seek advice from an experienced life insurance policy agent or financial advisor to figure out the ideal choice for your distinct requirements and economic goals. While IUL uses lots of benefits, it's also crucial to be knowledgeable about the risks and considerations linked with this kind of life insurance policy plan.

Let's dig deeper into each of these risks. Among the key problems when considering an IUL plan is the numerous expenses and fees related to the plan. These can consist of the price of insurance coverage, policy charges, abandonment costs and any type of additional rider expenses incurred if you include additional benefits to the policy.

Some may use a lot more affordable prices on insurance coverage. Examine the financial investment alternatives offered. You desire an IUL policy with a range of index fund selections to satisfy your requirements. Make sure the life insurance company straightens with your individual economic goals, demands, and risk resistance. An IUL plan must fit your details circumstance.

What happens if I don’t have High Cash Value Indexed Universal Life?

Indexed global life insurance coverage can supply a variety of advantages for insurance policy holders, including versatile costs repayments and the potential to earn greater returns. The returns are restricted by caps on gains, and there are no guarantees on the market performance. All in all, IUL policies supply a number of prospective advantages, however it is important to understand their risks.

Life is not worth it for the majority of individuals. For those looking for foreseeable lasting cost savings and assured death advantages, whole life may be the better choice.

How much does Indexed Universal Life For Wealth Building cost?

The benefits of an Indexed Universal Life (IUL) policy include potential greater returns, no disadvantage threat from market activities, security, adaptable repayments, no age requirement, tax-free death advantage, and car loan accessibility. An IUL plan is irreversible and supplies money worth growth via an equity index account. Universal life insurance policy started in 1979 in the United States of America.

By the end of 1983, all major American life insurers supplied global life insurance policy. In 1997, the life insurance company, Transamerica, presented indexed universal life insurance policy which offered insurance policy holders the ability to link plan development with worldwide stock exchange returns. Today, global life, or UL as it is likewise understood can be found in a selection of different forms and is a huge part of the life insurance policy market.

The info supplied in this post is for instructional and informational functions only and need to not be interpreted as financial or financial investment guidance. While the author has know-how in the subject matter, readers are recommended to speak with a certified monetary expert prior to making any type of financial investment decisions or purchasing any type of life insurance policy products.

How long does Indexed Universal Life coverage last?

You may not have actually assumed a lot about exactly how you desire to invest your retired life years, though you most likely understand that you don't desire to run out of cash and you would certainly like to maintain your present way of life. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings". Indexed Universal Life tax benefits.] < map wp-tag-video: Text shows up alongside business male talking with the video camera that reviews "company pension plan", "social security" and "financial savings"./ wp-end-tag > In the past, people relied on 3 primary incomes in their retired life: a company pension, Social Safety and security and whatever they would certainly managed to save

Less companies are using typical pension. And several companies have actually lowered or terminated their retirement strategies. And your ability to rely solely on Social Security remains in inquiry. Also if benefits have not been reduced by the time you retire, Social Safety alone was never meant to be adequate to pay for the lifestyle you desire and deserve.

Before committing to indexed universal life insurance, right here are some benefits and drawbacks to think about. If you choose a good indexed global life insurance policy strategy, you may see your cash money value expand in value. This is handy due to the fact that you might be able to gain access to this money prior to the strategy ends.

What are the benefits of Indexed Universal Life Tax Benefits?

Considering that indexed universal life insurance policy calls for a certain level of threat, insurance coverage firms have a tendency to keep 6. This type of plan additionally offers.

Typically, the insurance policy business has a vested interest in doing better than the index11. These are all aspects to be taken into consideration when choosing the ideal type of life insurance for you.

Nevertheless, since this sort of plan is a lot more complex and has an investment part, it can often feature greater costs than various other policies like whole life or term life insurance - IUL companies. If you don't assume indexed universal life insurance policy is best for you, right here are some alternatives to take into consideration: Term life insurance policy is a momentary plan that normally offers coverage for 10 to three decades

Table of Contents

Latest Posts

Iul Cost

No Lapse Guarantee Universal Life Insurance

Universal Vs Term Life

More

Latest Posts

Iul Cost

No Lapse Guarantee Universal Life Insurance

Universal Vs Term Life